Bank of England base rate

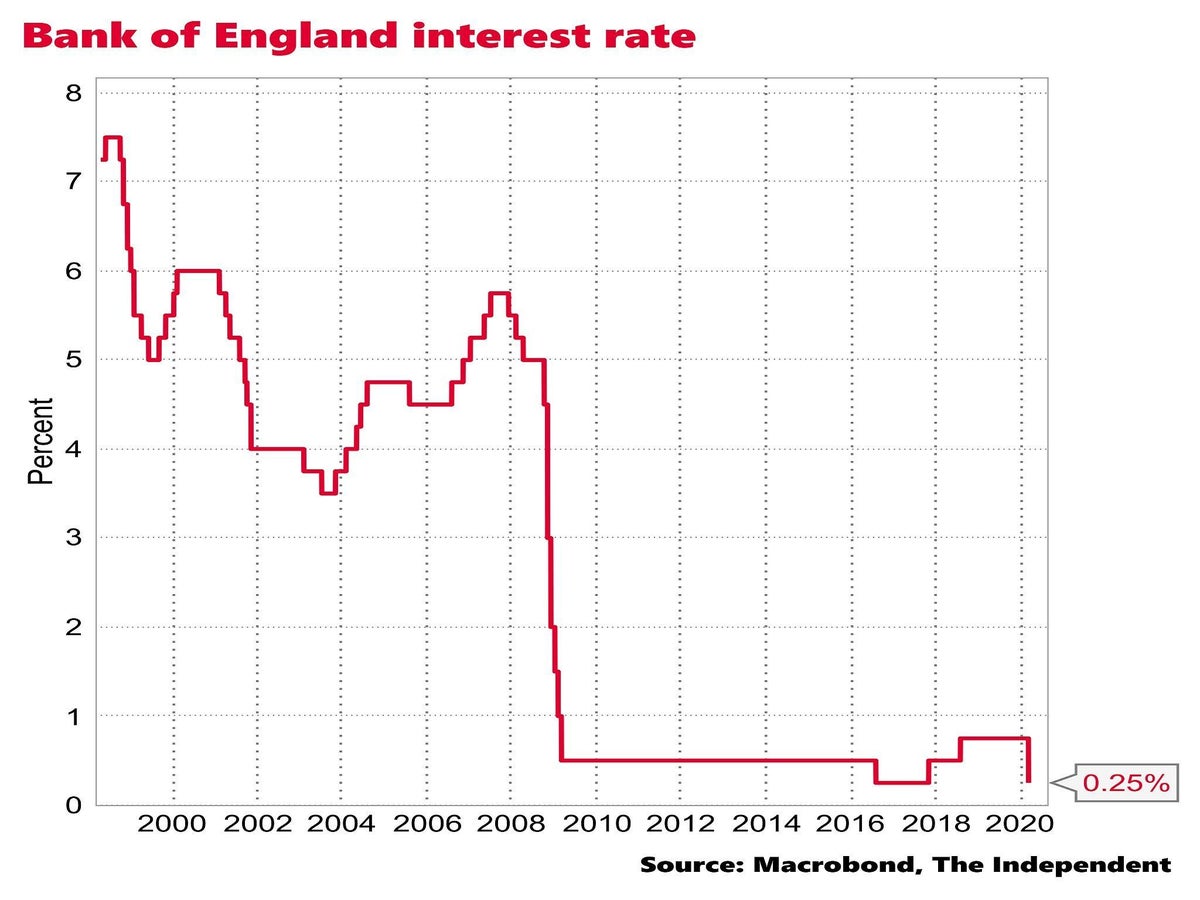

Index performance for UK Bank of England Official Bank Rate UKBRBASE including value. It strongly influences UK interest rates offered by mortgage lenders and monthly repayments.

Linkedin

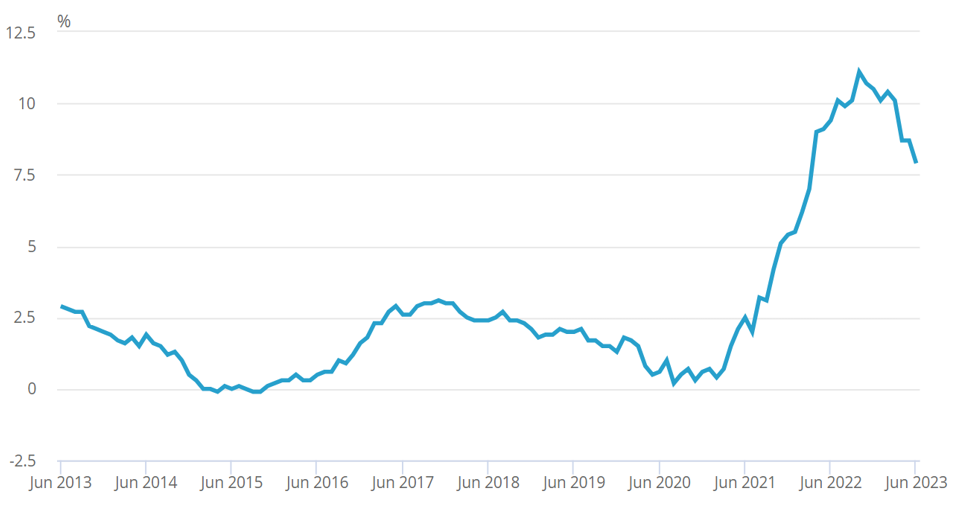

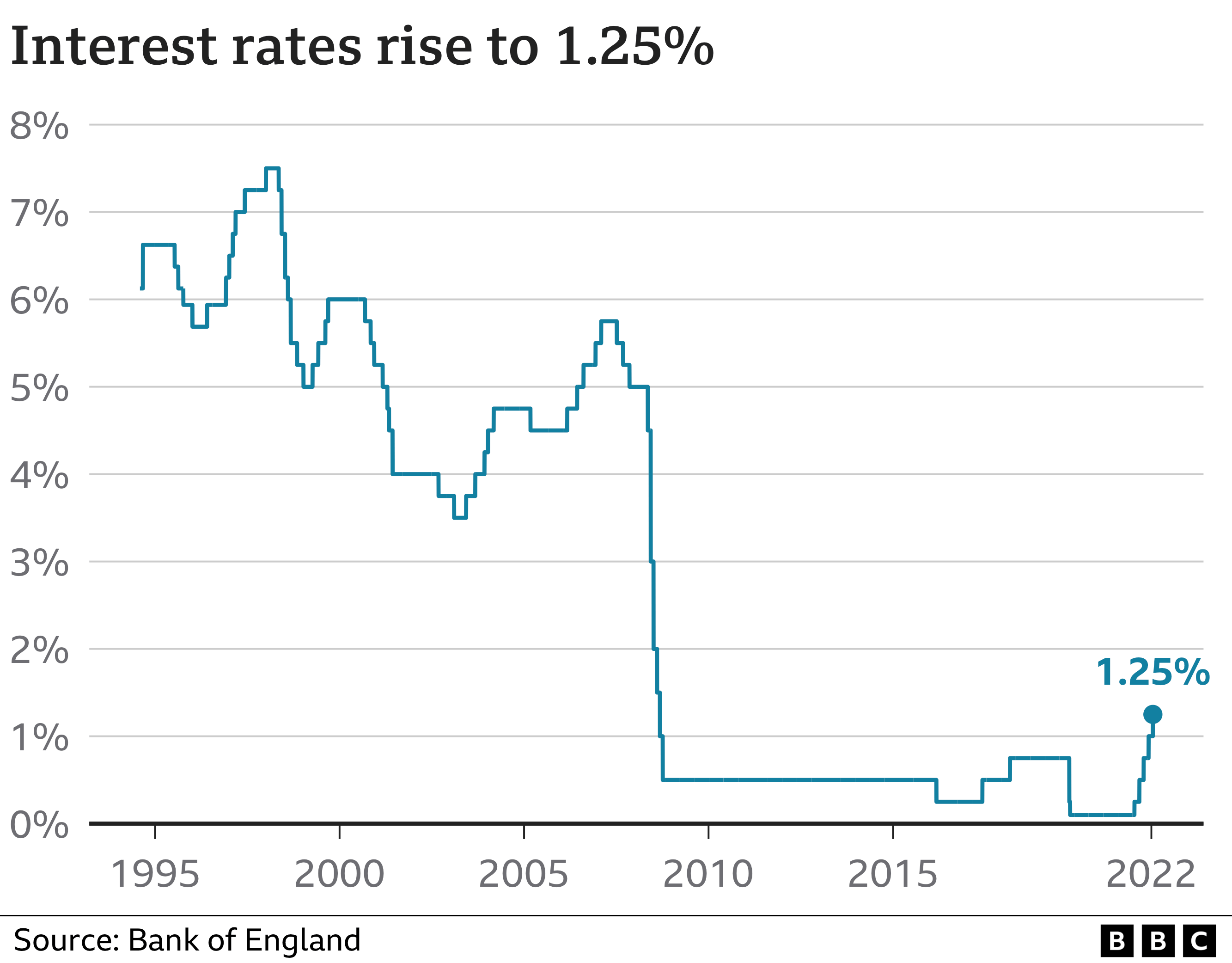

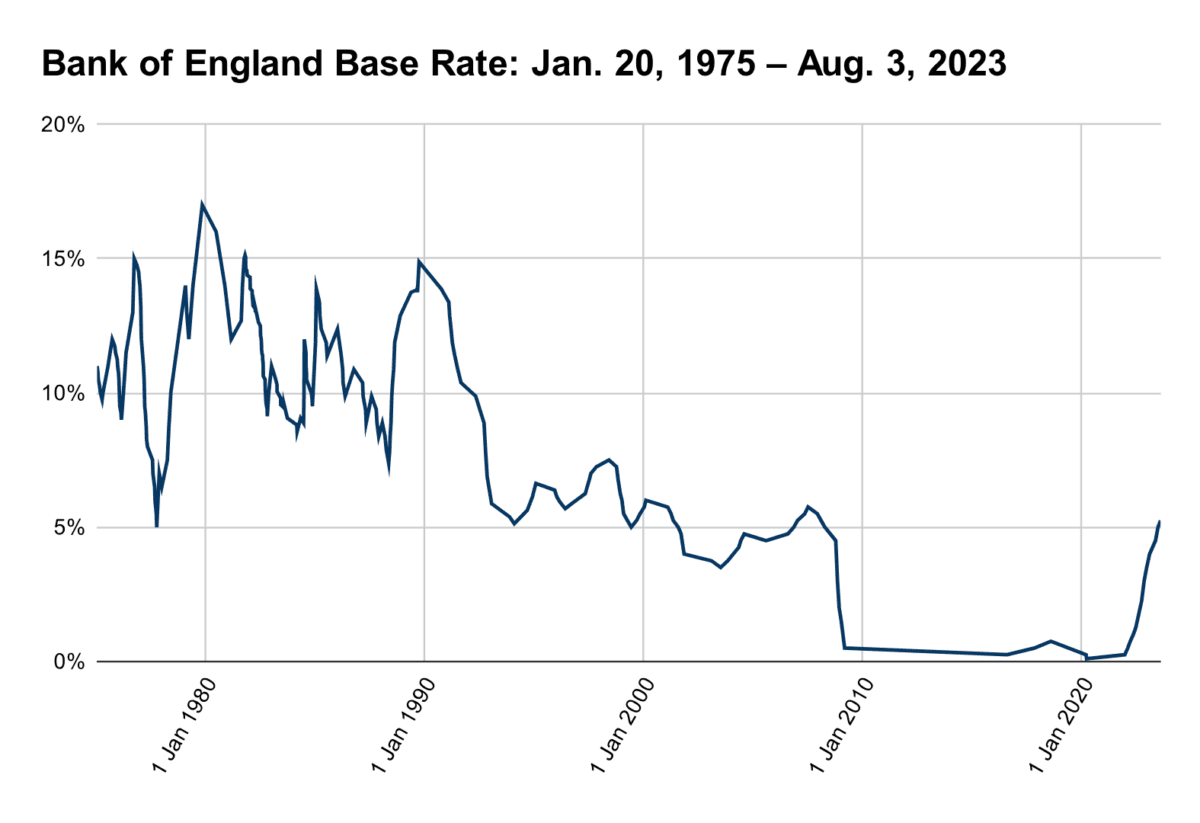

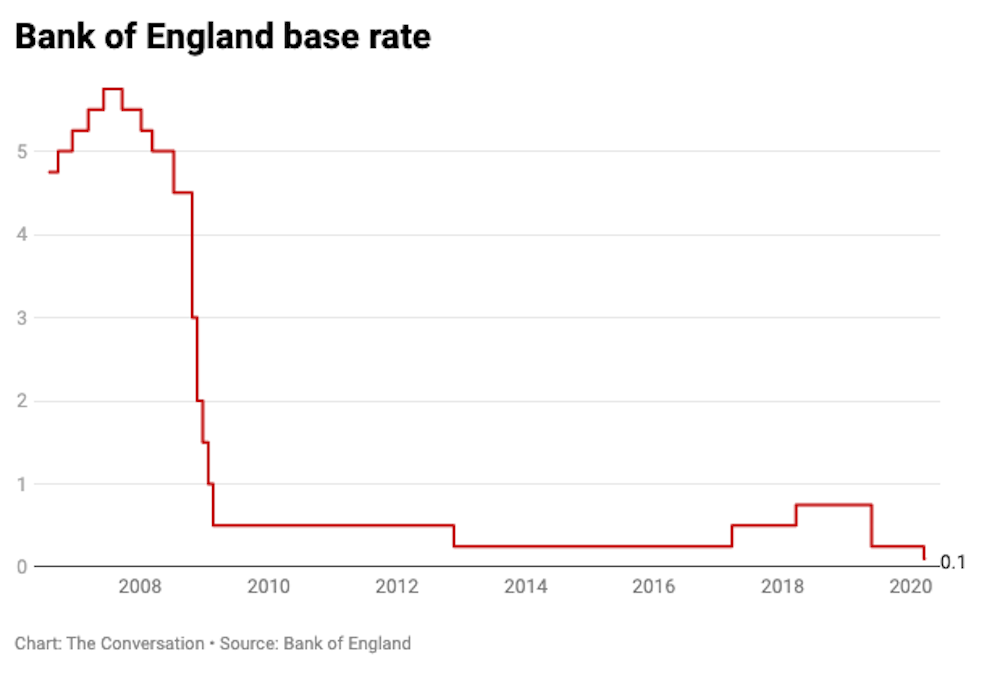

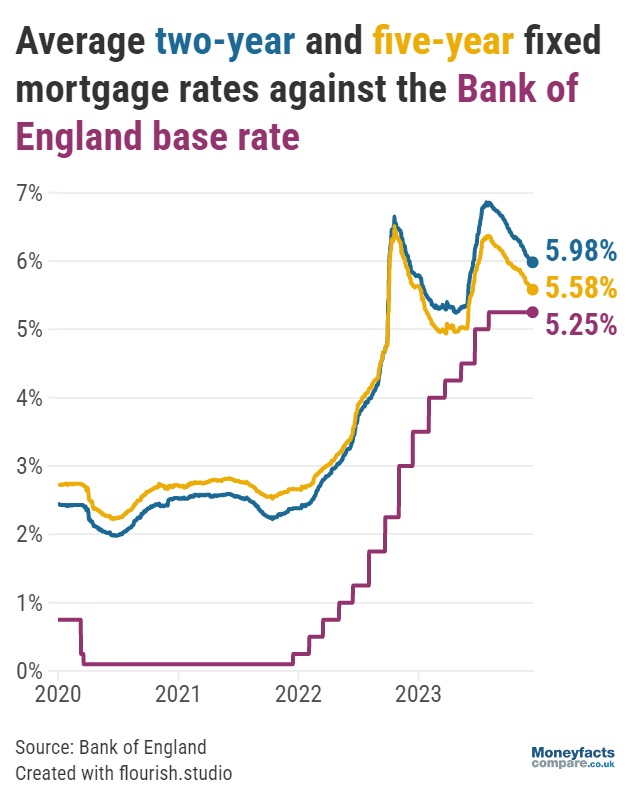

Web The Bank of England increased its base interest rate to 525 from 5 meaning the cost of borrowing for mortgages credit cards and other loans is at its highest level since 2008.

. The Bank of England has raised the UK base interest rate to 525 Inflation is falling and thats good news. Its the twelfth consecutive time the central bank has increased rates. Web Learn about interest rates and Bank Rate.

This rate is used by the central bank to charge other banks and lenders when they borrow money and so it influences what borrowers pay and what savers earn. Web The base rate is the Bank of Englands official borrowing rate. King Charles III banknotes will enter circulation from 5 June.

Our Monetary Policy Committee MPC sets Bank Rate. Web The current Bank of England base rate is 525. Web The Bank of England has increased the base rate from 45 to 5 taking it to its highest level since the 2008 financial crisis.

Web The Bank of England has voted to keep the base rate at 525. Web The Bank will lower the base interest rate to 3 by the end of 2025 according to analysis by research firm Capital Economics forecasting the first rate cut for June this year. Web As expected the Bank of England decided to hold its base interest rate which influences the rates set by High Street banks at 525 for the second time in a row.

Web The Bank of England raised interest rates for a 12th consecutive time - from 425 to 45 It is the highest level for almost 15 years. It had been expected to raise the base rate from 525 to 55. In the news its sometimes called the Bank of England base rate or even just the interest rate.

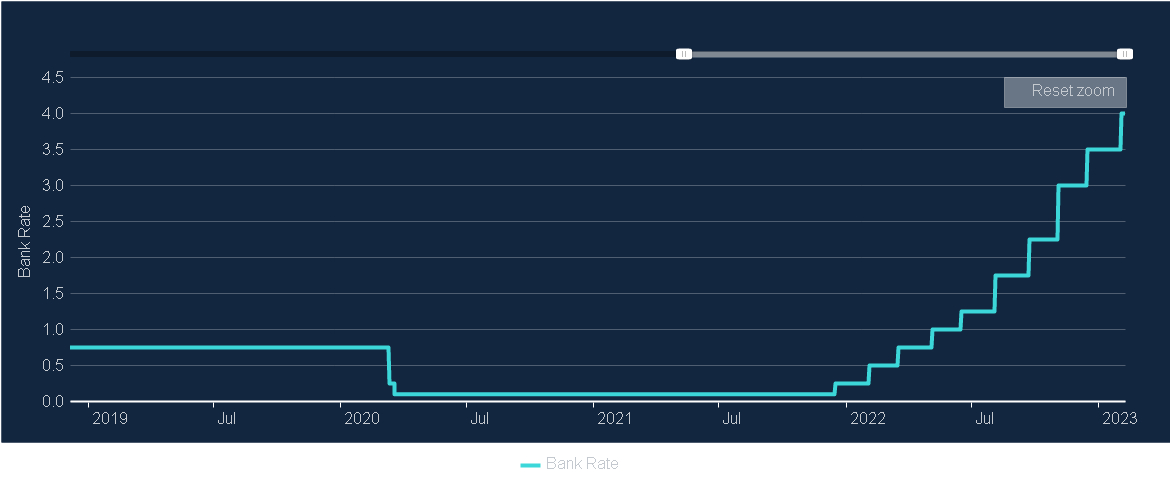

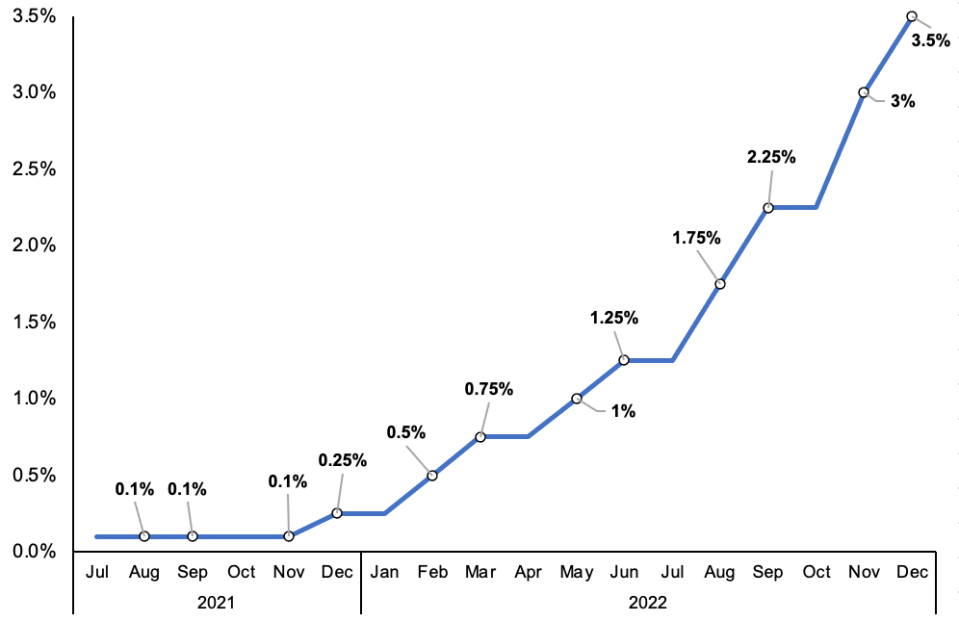

Web The Bank of England leaves interest rates unchanged in a surprise move. The reason for the latest rise the Bank says is to further. At its meeting ending on 3 August 2022 the MPC voted by a majority of 8-1 to increase Bank Rate by 05 percentage points to 175.

Web The Bank of Englands base rate currently 525 is what it charges other lenders to borrow money. The Bank of England held the base interest rate at 525. The base rate has been rocketing over the past year or so.

Web At its meeting ending on 22 March 2023 the MPC voted by a majority of 72 to increase Bank Rate by 025 percentage points to 425. It marks the third time in a row that the UK cost of borrowing remained unchanged at a 15-year high. Web Bank Rate is the single most important interest rate in the UK.

It is currently 05. Its the fourth time in a row that the Banks Monetary Policy Committee has opted to keep the base rate unchanged. This rate is used by the central bank to charge other banks and lenders when they borrow money and so it influences what borrowers pay and what savers earn.

HMRC interest rates are linked to the Bank of England. Global growth is expected to be stronger than projected in the February Monetary Policy Report and core consumer price inflation in advanced. Web The Bank of England holds interest rates at 525 for the fourth time in a row.

Web Stocks Fall Before Nvidias Must-Watch Earnings. Before this there had been almost two years of consecutive hikes. The Banks committee voted 6-3 in favour of holding the rate - two wanted an increase one wanted a cut.

Web The Bank of Englands Monetary Policy Committee MPC sets monetary policy to meet the 2 inflation target and in a way that helps to sustain growth and employment. Web The Bank of England has increased the base rate from 425 to 45 taking it to its highest level since 2008. Web The Bank of England Monetary Policy Committee announced an increase to the Bank of England base rate from 500 to 525 on 3 August 2023.

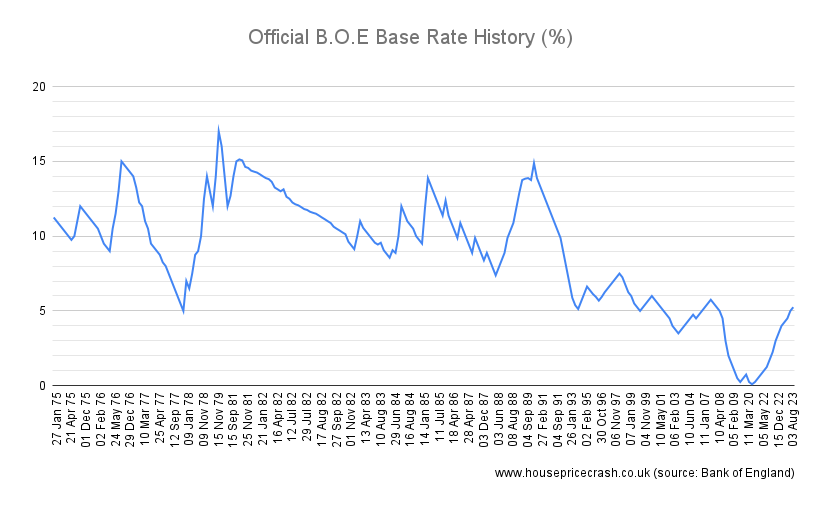

Web In depth view into Bank of England Bank Rate including historical data from 1975 to 2023 charts and stats. Bank of England Bank Rate IBEBR 525 for Aug 03 2023. Information about wholesale baserate data.

Web To sum up what we saw. Web Promoting the good of the people of the United Kingdom by maintaining monetary and financial stability. Web In a widely expected decision the Banks monetary policy committee MPC voted by a majority to keep interest rates at the current level of 525 the highest level since the 2008 financial crisis.

Then the rises began. Two members preferred to maintain Bank Rate at 4. It dropped to an all time low of 01 in March 2020 to try and help the economy survive impact of coronavirus and stayed there until November 2021.

Researchgate

1

Bbc

Purple Frog Property

1

House Price Crash

Nerdwallet

Which Co Uk

The House Of Commons Library Uk Parliament

The Conversation

New Statesman

Moneyfacts

Capital Com

City A M

![]()

Property Beacon

Mortgage Solutions

The Independent